FAIR MARKET VALUE DETERMINATION

There are a myriad of reasons for obtaining a Fair Market Value [FMV], Venture Capital [VC} and/or Investment Banking [IB] funding appraisal engagement:

- Outright Selling-Buying

- Partnership and Associate buy-in / buy-out

- Mergers and Acquisitions

- Organic growth tracking

- Hospital integrations

- Private and public reporting

- Financing and Venture Capital

- Estate and Tax Planning

And, there are many cautions, too. On July 19, 2023, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) released a draft update of its Merger Guidelines, which guides the regulatory agencies in their review of both mergers and acquisitions in evaluating compliance with federal antitrust laws.

The new Guidelines replace, amend, and consolidate the Vertical Merger Guidelines and Horizontal Merger Guidelines, which were published in 2020 and 2010, respectively.

Our Value Analysis

At D.E. Marcinko & Associates, we have the ability to provide extensive entrepreneurial analysis of mergers & acquisition value components in healthcare practices and provide appraisals based on business, economic and market conditions. This involves detailed examination of financials and clinical data in the context of numerous factors including medical specialty, physician supply and demand, payer mix, regulatory environment, regional dynamics and risk premium, etc.

Our Fair Market Valuation Process:

Part I—Planning the Medical Practice Valuation

- Purpose of the Appraisal

- Goals and Objectives of the Appraisal

- Source Data and Fact Gathering

- Due Diligence Preparation

- Professional Practice Comparative Information

- Sources of Professional Practice Industry Financial Data

- Selecting the Valuation Method of Choice Approach

Part 2—Professional Practice Valuation Approaches

- Income Approach

- Market Approach

- Asset-Based Approach

- The Excess Earnings Method

Part 3—Fractional Practice Ownership Interests and Estimated Value

- Reasons to Appraise a Fractional Ownership Interest

- Approaches to the Valuation of Percentage Ownership Interests

- Percentage Ownership Interest Valuation Discounts and Premiums

- Discount/Premium for Lack/Mandate of Control (Minority versus Majority)

- Discount/Premium for Lack/Mandate of Marketability and Sale

- Discounts and Premiums for Other Non-systematic Risk Factors

- Sequencing of Discounts and Premiums

- Medical Practice Capitalization Rate Construction

- The Reconciliation and Review Process

- Relationship of Review Valuation Process

- Reconciliation Criteria

- Final Value Estimate

- Valuation Conclusion

- Presentation of Valuation Conclusion

- Independence Statement

- Opinion of Value Range

- Summary Report to Principals

Part 4—Reporting the Professional Practice Valuation Results

- Introduction to Valuation Reporting Standards

- Appraisal Reporting Standards

- Elements of the Appraisal

- Retention of Appraisal Reports and Files

- Uniform Standards of Professional Appraisal Practice

- USPAP Format and Style

- Confidentiality Provisions

- Glossary of Terms

- Summary and Conclusion

Part 5—Appendices

- Appendix: Bibliography of Principle Valuators

- Appendix: Standards of the American Society of Appraisers; etc

- Appendix: Standards of the Institute of Business Appraisers; etc

OUR HEALTH INDUSTRY VALUATION NOTORIETY: Part (1) – Part (2) – Part (3)

***

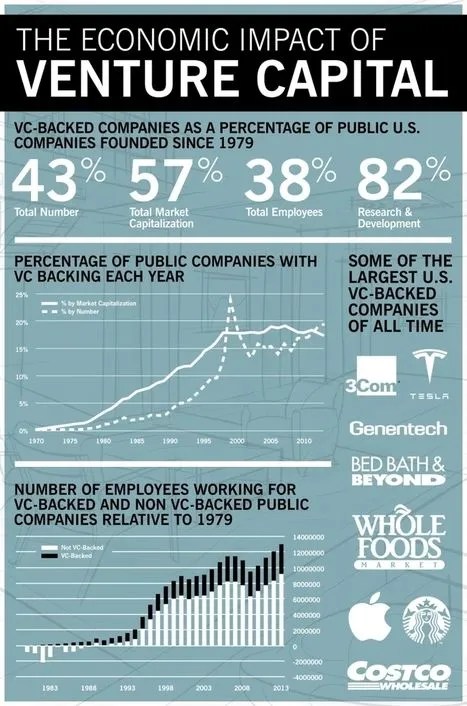

RAISING VENTURE CAPITAL FUNDS

What is Venture Capital [VC] and Investment Banking [IB]?

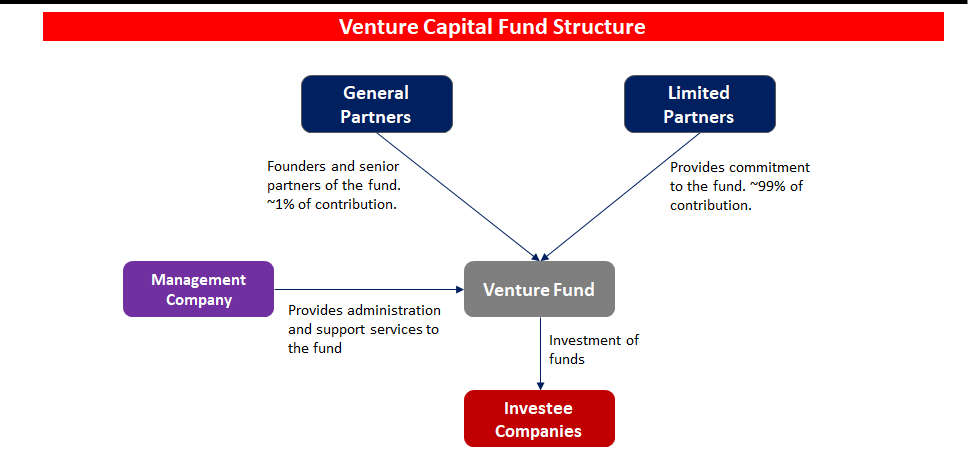

Venture capital (VC) is a form of private equity and a type of financing that investors provide to healthcare start-up companies and small medical clinics or practice businesses that are believed to have long term growth potential. Venture capital generally comes from well-off investors, Investment Bankers [IBs] or any other financial institutions. It is the opposite of “boot-strapping”, but venture capital doesn’t always have to be money. In fact, it often comes as technical or managerial expertise. IBs typically allocate to small companies with exceptional growth potential or to those that grow quickly and appear poised to continue to expand.

Typically, investors have to be accredited (someone with a net worth of at least $1 million). The minimum needed to invest in a venture capital fund varies by fund. Minimums can range, for example, anywhere from $1,000 to $500,000 or higher.

And so, VCs and IBs assist your funding in the following ways:

Early-stage capital: Some VCs provide funds before a startup begins operating as a business, helping to replace money spent in research and development. This type of venture capital assumes the most risk but allows for the greatest profit and growth potential by earning a share in the eventual revenue of the startup.

Expansion capital: When a company is ready for next-level growth, VCs invest the capital to expand a proven business model. With the risk now significantly reduced, VCs and IBs provide money to help the business further market its brand and emerge into new markets.

Late-stage capital: When a company has gained momentum and is producing revenue, risk is at its lowest. At this stage, VCs provide funds as a short-term investment, as the company may require help to increase its available cash flow for business operations as it continues to grow.

Acquisition/buyout capital: Some VCs specialize in providing funds to help set up the initial public offerings [IPO] of companies ready to go public, along with helping to find buyers in mergers and acquisitions. VCs and IBs involved in this stage of a company can earn money by selling off their stock.

Mezzanine: During this stage, the startup may have an IPO or acquisition. Investors and VC firms may begin frequently selling stock.

“Unicorn”: A term commonly used by private investors and venture capitalists after being coined in 2013 by Aileen Lee. The term refers to a startup business with a value exceeding $1 billion. Unicorns are rare but heavily desired. Some popular examples of unicorns include Alphabet (aka Google), Facebook, Epic Games, and SoFi.

Now generally, things are beginning to look up for startups after a long fundraising drought. Venture funding grew 26% QoQ, the first such increase since 2021, according to venture platform provider Carta’s State of Private Markets Q-2, 2023 Report. The report brought more good news for startups, including upticks in early stage valuations and later-stage deal counts. Carta aggregated its data from the companies and security holders that use its platform.

Healthcare Start-Ups: https://tinyurl.com/2tdyxh88

But, it’s not all good news. Later-stage companies are successfully raising money, but at lower valuations relative to the past few years. “Nearly 20% of all rounds last quarter were down rounds, the second-highest quarterly figure of the past five years.”

More specifically, at D.E. Marcinko & Associates, we appreciate that Venture capital funding for entrepreneurs in the digital health space cooled a bit in 2022 following a red-hot 2021. Overall, digital health companies raised $15.3 billion last year, down from the $29.1 billion raised in 2021—but still above the $14.1 billion raised in 2020, according to Rock Health a seed fund that supports digital health startups.

Nevertheless, other analysts predict VC investors and IBs will still put a good amount of money into digital health in 2024 thru 2027, especially in alternative care, drug development, health information technology, artificial intelligence, EMRs and software that reduces physician workload.

An essential first part of attracting VC interest and IB money is the crafting and presentation of your formal business plan [“elevator pitch”]; as well as the needed technical and managerial experience. This too is crucial for success and exactly where we can assist.

Of course, companies focused on scaling and growing will have different needs across the business lifecycle. No matter where you are in your journey—from seeking early funding to making final preparations for your IPO—we have equity and insightful administration solutions for you and can assist at any stage of your growth spectrum

MORE: investment-banking

HOW MAY WE SERVE YOU?

Contact: Ann Miller for all related engagement details: email: MarcinkoAdvisors@outlook.com

© Institute of Medical Business Advisors, Inc. Content copyrighted present to 2025. All rights reserved, USA.

***