| COMMENTS ON PHYSICIANS AS CLIENTS AND ENTREPRENEURS |

| NO SELF-INDULGENT PATH TO SUCCESS |

“Most of my friends assume that doctors spend their money and time on flash and trash.” |

***

This jaw-dropping quote came from a young man I was talking with recently about his desire to run a medical practice as office administrator. I was shocked; this was a money script I had never heard. I asked if he was serious. He was. I asked if any of the friends with this belief were raised by a doctor or parent who owned a clinic or medical practice . He thought for a moment and said, “No, not one.” This conversation reminded me of a government employee who once told me, “Any person who succeeds in business had to do so illegally by embracing corruption and dishonesty.” He, too, was serious.

Well, I was dumbfounded by both of these encounters. My experience of being raised by parents who owned a small business, and then going into business for myself, was quite different from these perceptions. My father started his own business when I was four years old. I witnessed him working long hours. I remember the times when business was so bad he would have to borrow money to pay the bills and keep the doors open.

Later in life I learned his business rarely made a profit and was just able to pay his salary. He never shared with his employees how tight money was. When I went to work for him as a teenager, I remember listening to the talk around the water cooler. They all assumed he made far more money than what I knew was true. In the years since, I have discovered many misperceptions about people who own real estate, are in business, or who have accumulated wealth.

The first misperception is that someone who owns real estate, a medical practice or clinic has actually accumulated wealth. My 40 years of experience in financial planning has taught me that many, if not most, business owners would make more money working for someone else. And real estate owners accumulate wealth slowly. Most of them, myself included, struggle through some lean years with short or even negative cash flow until they finally pay off their home or business mortgages.

Certainly, real estate or business owners who persevere over the long term can become wealthy. Being wealthy, according to various studies, is defined as having a minimum net worth of somewhere between five million and twenty million dollars. About 80% of millionaires own their own businesses. Much like doctors, they put in long hours, often in careers they love enough so that work becomes play. The average business owner puts in about 70 hours a week. They are five times more likely than non-business owners to be “always available” via e-mail, four times more likely to work nights, and three times more likely to be in the office or store on weekends.

In other words: “Always On Call.”

This is the way one successful business owner described it: “Our company will celebrate its 50th anniversary next year. Probably the first 30 years were spent working 70-100 hour weeks at below minimum wage and dumping every extra penny back into the business. I would say it’s only been the last 10 years that we have begun to reap the financial rewards that we spent 40 years striving to attain, still working 60-70 hour weeks. I acknowledge our work habits may in part be a result of being stubborn Norwegians that don’t think anyone else can do things right, but most successful small business owners I know have pretty much dedicated their life to become successful.”

This focus and work ethic are what it takes to succeed at medical practice business ownership and entrepreneurship. It’s not a mindset that includes blowing money and time on “flash and trash”.

Thank You.

Rick Kahler MSFP CFP®

***

MY TAKE ON PRIVATE EQUITY AND VENTURE CAPITAL

Private equity and venture capital investments typically involve ownership of shares in a company and represent title to a portion of the company’s future earnings. However, private equity is an equity interest in a company or venture whose stock is not yet traded on a stock exchange.

Venture capital is typically a special case of private equity in which the investment is in a company or venture that has little financial history or is embarking on a high risk/high potential reward business strategy.

Like real estate, private equity and venture capital investments generally share a general lack of liquidity and a lack of comparability across different individual investments. The lack of liquidity comes from the fact that private equity and venture capital investments are typically not tradable on a stock exchange until the company has an IPO.

The lack of comparability is due to the fact that most private equity and venture capital investments are the result of direct negotiation between the investor/venture capitalist and the existing owners of the company /venture.

With widely divergent terms and provisions across different investments, it is difficult to make general claims regarding the characteristics of private equity and venture capital investments.

Thank You.

Lon Jefferies MBA CMP™ CFP®

***

***

THOUGHTS ON CROWD FUNDING

Start-ups and small businesses were able to sell ownership stakes in their companies by soliciting investors over the Internet under a proposal advanced by the Securities and Exchange Commission [SEC]. The plan set rules for equity Crowd-Funding which spurred growth by easing financing for companies when mandated in the 2012 Jumpstart Our Business Startups Act. [JOBSA] The rules boosted the nascent Crowd-Funding movement that demonstrates progress in advancing a backlog of regulations required by the JOBS Act and Dodd-Frank law. Firms include: KickStarter, RockHub, CrowdFunder, PeerBackers, AngelList, and others.

For example, businesses using Crowd-Funding could raise no more than $5,000 a year from someone whose income or net worth is less than $100,000. Investors with income or net worth greater than $100,000 could contribute as much as 10 percent of their annual income or net worth, to a maximum of $100,000 in one year. Crowd-Funding wouldn’t be open to public companies, non-U.S. companies, or those that have no specific business plan.

A company using equity Crowd-Funding would be limited to raising a maximum of $1 million per year. Companies raising less than $100,000 would have to disclose financial statements and income-tax returns for the most recent fiscal year. A company seeking to raise more than $500,000 would have to provide audited financial statements. Companies raising more than $100,000 but less than $500,000 would need to provide financial statements reviewed by an independent public accountant.

But, to date, I know of no successful Crowd-Funding initiatives specifically for physician entrepreneurs, clinics, hospitals or medical practices, etc.

Thank You.

Timothy J. McIntoch MBA MPH CFP®

***

***

ABOUT PEER-TO-PEER LENDING (P2PL)

Similar to private equity or venture capital, peer-to-peer lending [aka person-to-person lending, peer-to-peer investing, and social lending] is the practice of lending money to unrelated individuals without the benefit a traditional financial intermediary like a bank or financial institution. P2P lending takes place online using various platforms and credit checking tools. It has been in existence for about almost two decades.

Here are some important characteristics:

P2PL offers a chance to get a lower interest rate than a bank, and gives investors a chance to receive higher returns. Of course, more rewards means more risk

The two largest P2PL companies are Prosper.com and LendingClub.com. Prosper is older, Lending Club is bigger. Prosper allows bidding on the interest rates you’re willing to provide a loan. Lending Club sets the rates.

Initial returns on Prosper were disappointing because default rates were high. For loans originating in 2010, both Lending Club and Prosper had a default rate of about 13.5%. Using loans from that same time period, Prosper had overall returns of 8.3% and Lending Club had returns of 4.3%. Today it is much better.

Since avoiding defaults is an important part of P2PL, investors should buy many lots of notes – for as little as $25 each – which make it relatively easy to achieve broad diversification.

Compared to buying index funds and re-balancing once a year, P2PL is more time-consuming as you must pick the loans to invest in individually. Filtering through the offered loans is time-consuming, but can be rewarding. Some investors sell off their notes at a discount once the borrower goes late on a payment for instance, or just because they need their money out of the investment before the term is up.

No matter how closely watched there will be a drag on returns from the cash in your portfolio. It takes time to choose loans acceptable and then for them to be approved. Just as with a mutual fund, this will lower your returns, perhaps as much as 1%.

One of the real benefits of P2PL is a low correlation with other investments, as it is different than other asset classes and ought to perform differently from equity and fixed income investments.

I am aware of physicians who invest in the above.

Thank You.

Jeffery S. Coons PhD CFA

***

U. S. HEDGE FUNDS

A hedge fund in the United States is generally a limited partnership providing a limited number of qualified investors with access to general partner investment decisions with little restriction in the type of investments or use of leverage. While the flexibility available to a hedge fund from a regulatory standpoint implies a high degree of potential risk, there is a wide range of investment philosophies, strategies, security types and objectives captured under the broad title of hedge fund.

Thus, generalizations regarding the characteristics of hedge funds are even less appropriate than with mutual funds, and evaluation of the investment characteristics and merits of a hedge fund strategy must be on a case-by-case basis. Likewise, the cost structure of a hedge fund often includes a base management fee to the general partner plus a performance-based fee or percentage of the profits, and must be evaluated on a case-by-case basis.

Several different investment vehicles operate under the oversight of varying regulatory bodies which provide access to an investment-managers’ discretionary decisions. While each approach generally represents ownership of an underlying pool of securities, there is usually a great deal of flexibility for the manager to deviate from a specific asset class or investment approach. Also, the fee structure of each vehicle can vary greatly and be quite large once distribution fees and sales charges are taken into account.

Thus, it is important for a medical professional to remember the following:

1. Evaluate the features and costs of an investment vehicle carefully;

2. Consider the cash flows and valuations of the securities that the manager or management approach will focus on as if the investments were being made directly, and above all;

3. Read the prospectus or agreement carefully before making any investment.

Thank You.

Christopher J. Cummings CFA CFP™

***

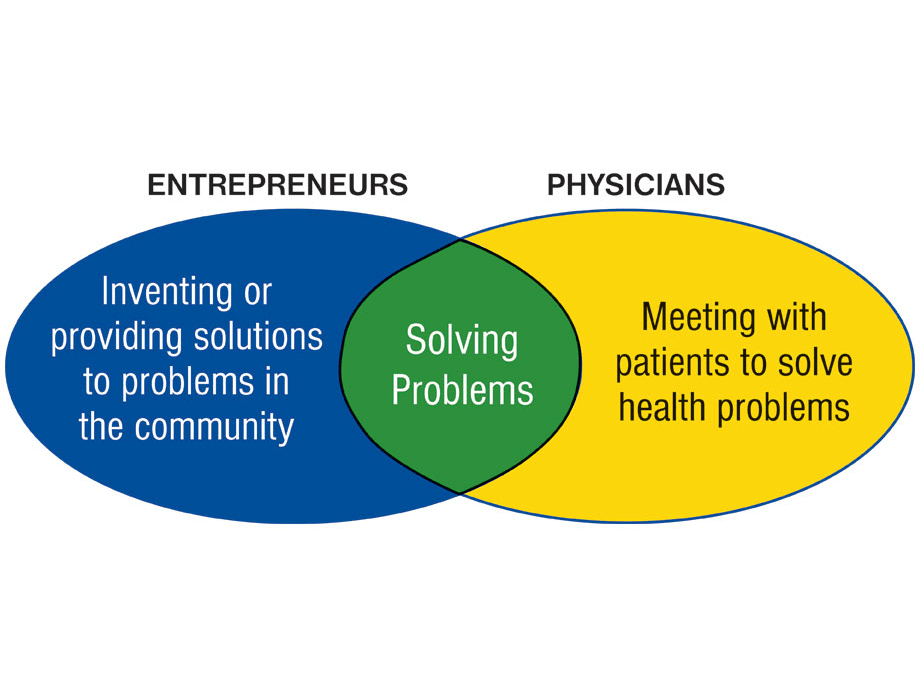

SOCIETY OF PHYSICIAN ENTREPRENEURS

The Society of Physician Entrepreneurs (SoPE) was established as a community of interest in 2008 by several members of the American Academy of Otolaryngology – Head and Neck Surgery (AAO-HNS), including Dr. Arlen Meyers, the founding past President & CEO. SoPE became a separate and independent legal entity; incorporating in Washington, D.C. in January 2011. It is a 501 (c) 6 member organization with the stated purpose of providing support; idea stage through funding, for physician entrepreneurs with ideas on how to improve healthcare.

SoPE’s vision is to accelerate physician originated biomedical innovation.

The mission of SoPE is to foster scholarship in biomedical entrepreneurship and provide education, training and support; idea stage through funding, to primarily community-based physician entrepreneurs in the interest of better healthcare.

SoPE membership is open to all physicians and also accepts individuals as associate members; representatives of medical device, legal, venture capital, and other firms with an interest in serving and/or supporting physician entrepreneurs.

Website: www.sopenet.org

Thank You.

Dr. David Edward Marcinko MBA MEd CMP™

***

INDEPENDENT PHYSICIANS v. CORPORATE MEDICINE

Independent doctors looking to remain in practice—as major health systems buy up their colleagues—should capitalize on patient trust to remain competitive. And, although patients value the personal experience and higher quality care offered at independent practices, they will seek care elsewhere for convenience, speed and lower cost.

So, patients really appreciate the speed of corporate healthcare.

But when it comes to conditions that might be more difficult to diagnose or for treatment of chronic conditions—things where they might need a little bit more from their doctors—that’s when bedside manner with their independent physicians become most important.

Coaching and mentoring is also helpful.

Thank You

Dr. Elizabeth Starves-Kline

***

SIX TYPES OF FINANCIAL PROFESSIONALS

- 𝗖𝗙𝗢𝘀 are heavily invested in strategic planning, leadership, and risk management, often overlooking the entire financial spectrum.

- 𝗖𝗼𝗻𝘁𝗿𝗼𝗹𝗹𝗲𝗿𝘀 play a key role in accounting, financial reporting, and regulatory compliance, ensuring financial integrity.

- 𝗙𝗣&𝗔 𝗠𝗮𝗻𝗮𝗴𝗲𝗿𝘀 focus on financial modeling, analytical skills, and business acumen to drive business growth.

- 𝗜𝗻𝘁𝗲𝗿𝗻𝗮𝗹 𝗔𝘂𝗱𝗶𝘁𝗼𝗿𝘀 specialize in risk management, regulatory compliance, and analytical tasks to ensure internal control.

- 𝗙𝗶𝗻𝗮𝗻𝗰𝗲 𝗔𝗻𝗮𝗹𝘆𝘀𝘁𝘀 are adept at financial modeling, analytics, and reporting to support data-driven decisions.

- 𝗔𝗰𝗰𝗼𝘂𝗻𝘁𝗮𝗻𝘁𝘀 emphasize accounting skills, financial reporting, and regulatory compliance for precise record-keeping.

Thank You.

Aleksandar Stojanović MSc

***

IS “INFINITE BANKING” A SCAM?

Infinite banking is a complicated financial life insurance concept. What’s more, borrowing from a whole life insurance policy rather than a bank introduces a unique set of problems. These loans don’t have set repayment schedules but they do accrue interest. Here’s what you should know about borrowing from an insurance policy:

Pros

- Easier to secure than a bank loan, especially if you have bad credit.

- May only take a few days to receive funds.

- Interest rates may be lower than other loans.

Cons

- You may need to pass a physical to qualify for an insurance policy.

- Policy loans can decrease the death benefit.

- Premiums can run significantly higher than comparable term policies

- Payment issues can result in losing your policy and/or paying tax penalties.

- Interest rates may be variable and fixed rates can be high.

- Borrowing limits are often capped at a percentage of the cash value.

- It can take years to accrue enough cash value to take out a significant loan.

Thank You

Anonymous

***

TEXTBOOK REVIEW

“COMPREHENSIVE FINANCIAL PLANNING STRATEGIES FOR DOCTORS AND ADVISORS”

This is an excellent major 800 page text book on financial planning for physicians, health professionals and their financial advisors. It is all inclusive yet very easy to read with much valuable information. And, I have been expanding my business knowledge with all of team Marcinko’s prior books. I highly recommend this one, too. It is a fine and specific educational tool for all physicians and medical professionals.

Thank You.

David B. Lumsden MD MS MA

***

NOTE: Readers, associates, strategic alliance partners and clients are encouraged to comment as they see fit. Comments and opinions may be edited for uniform style, length, subject matter or clarification, etc. Please email all comments to: MarcinkoAdvisors@msn.com

**

© Copyright: Institute of Medical Business Advisors, Inc. All rights reserved, USA. Present to 2024.

***